Intelligent loan assistant reduce CAC by 32%

Intelligent loan assistant reduce CAC by 32%

Intelligent loan assistant reduce CAC by 32%

Smart AI loan assistant enabling users to reduce interest costs by 20%

Smart AI loan assistant enabling users to reduce interest costs by 20%

Timeline

Timeline

Timeline

Product type

Product type

Product type

Platform

Platform

Platform

Industry

Industry

Industry

Introduction

Introduction

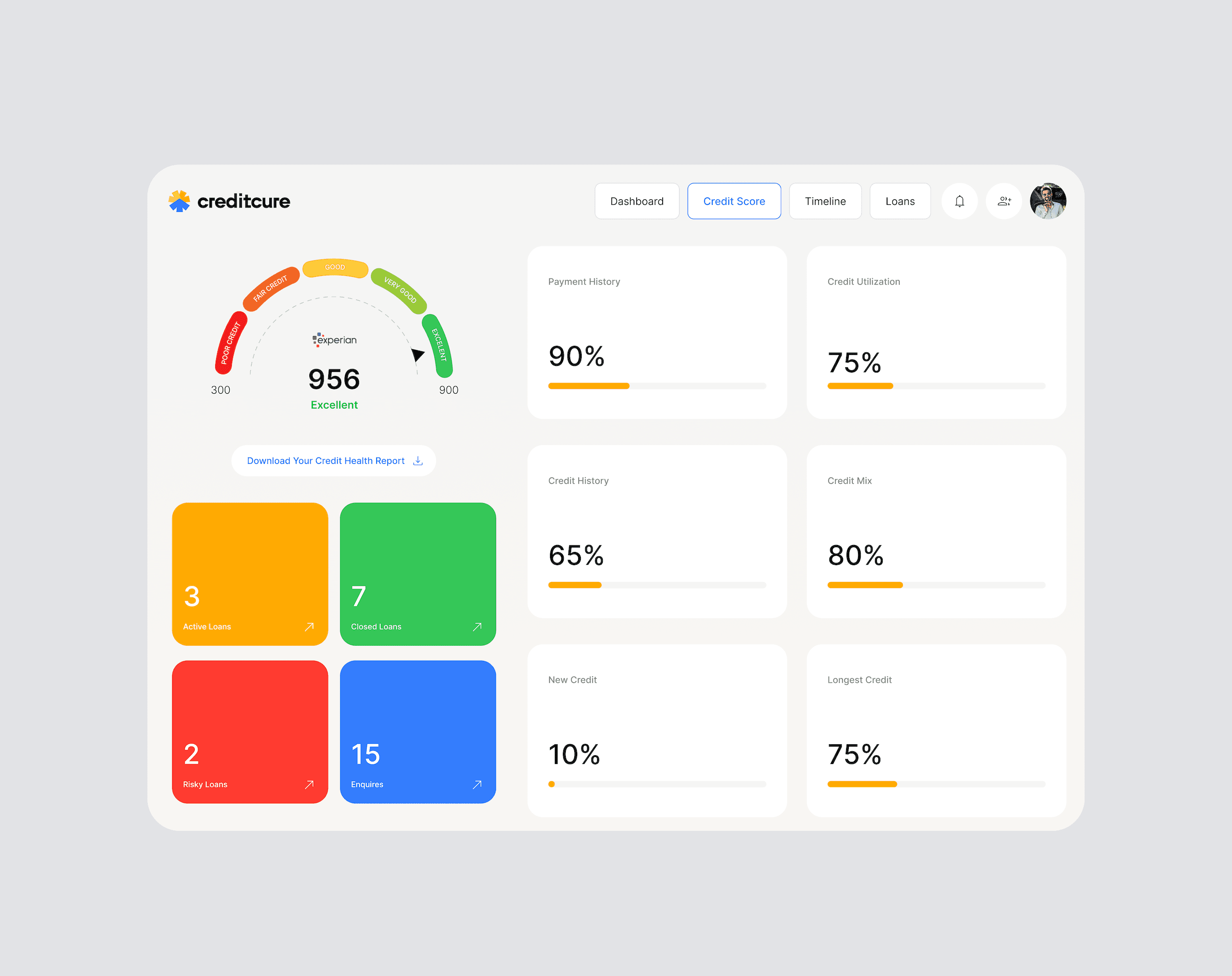

Creditcure financial assistant helps users identify loans with high interest payments, and helps them reduce interest burden by 20%

Creditcure financial assistant helps users identify loans with high interest payments, and helps them reduce interest burden by 20%

Product Overview

Product Overview

Creditcure AI Assistant is a WhatsApp first AI assistant for creditcure customers. It can help users get information about their credit scores, identify high interest loans and also help them transfer loan to another bank, hence saving them on interest payments.

Creditcure AI Assistant is a WhatsApp first AI assistant for creditcure customers. It can help users get information about their credit scores, identify high interest loans and also help them transfer loan to another bank, hence saving them on interest payments.

Challenge

Challenge

1. Identifying Customer Intent based on WhatsApp Chat:

One of the initial problems that arrises in building chat based systems is identifying the intent of the user. The user can say any sentence and in any language or format. Identifying the correct intent based on that message will accordingly allow the user further actions. For Creditcure, it was identifying intent of getting loan information, identifying savings, new bank routing or general inquiries.

What We Did

We built an intent agent which was fine-tuned to identify the intent of the user. The intent to be identified was of loan information, identify savings, bank routing, or general query intent. Whenever a new user input is received, this agent identifies the user intent and accordingly redirect the user flow to respective flow.

1. Identifying Customer Intent based on WhatsApp Chat:

One of the initial problems that arrises in building chat based systems is identifying the intent of the user. The user can say any sentence and in any language or format. Identifying the correct intent based on that message will accordingly allow the user further actions. For Creditcure, it was identifying intent of getting loan information, identifying savings, new bank routing or general inquiries.

What We Did

We built an intent agent which was fine-tuned to identify the intent of the user. The intent to be identified was of loan information, identify savings, bank routing, or general query intent. Whenever a new user input is received, this agent identifies the user intent and accordingly redirect the user flow to respective flow.

Solution

Solution

We designed the assistant by gathering right data, frameworks and specialised model. We trained the model to learn on the frameworks and adapt to the changing data as per customers. We also built human feedback in the process to enable reinforced learning.

We designed the assistant by gathering right data, frameworks and specialised model. We trained the model to learn on the frameworks and adapt to the changing data as per customers. We also built human feedback in the process to enable reinforced learning.

Results

Results

Result was robust assistant which helped users in guiding them to right loan with lower interest rate. This helped save interest cost and reduced CAC for creditcure by 32%.

Result was robust assistant which helped users in guiding them to right loan with lower interest rate. This helped save interest cost and reduced CAC for creditcure by 32%.

Conclusion

Conclusion

Over 2k+ deals closed on the custom CRM, and continues to scale effortlessly for our client.

Over 2k+ deals closed on the custom CRM, and continues to scale effortlessly for our client.

"We have worked with multiple agencies but Prognos Labs process, and quality oriented approach has been the best"

Ankit Agrawal

CEO and Co-Founder @MyDNAPedia

"We have worked with multiple agencies but Prognos Labs process, and quality oriented approach has been the best"

Ankit Agrawal

CEO and Co-Founder @MyDNAPedia

"We have worked with multiple agencies but Prognos Labs process, and quality oriented approach has been the best"

Ankit Agrawal

CEO and Co-Founder @MyDNAPedia

Ready to Launch Faster & Smarter?

Ready to Launch Faster & Smarter?

Let’s turn your product vision into reality — without the technical headache

Let’s turn your product vision into reality — without the technical headache